Why CoreWeave (CRWV) Is Down 16.4% After Major AI Partnerships and Q3 Earnings Miss

CoreWeave detailed third-quarter 2025 profit, posting US$1.36 billion in deals and a net misfortune of US$110.12 million, nearby declarations of major modern commercial understandings with CrowdStrike and Tremendous Information to fortify its AI cloud capabilities.

These advancements highlight CoreWeave’s quick advance in broadening its organizations and cementing its position in the extending AI foundation market.

We’ll investigate how CoreWeave’s association force and income development shape its venture account, particularly as venture AI request quickens. What Is CoreWeave’s Speculation Narrative?

To be a CoreWeave shareholder right presently, you have to accept in the company’s capacity to quickly capture an outsized share of the booming AI cloud advertise, in spite of its continuous misfortunes and later share cost instability. The later profit report, appearing both vigorous deals development and a narrowing net misfortune, bolsters the account that request for cloud-based AI foundation remains solid. Modern, high-value associations with CrowdStrike and Endless Information may offer assistance CoreWeave address short-term catalysts: growing cloud capacity, upgrading information security, and developing its undertaking impression. These assentions too hone the company’s edge as government showcase extension and expansive client contracts (like Meta and OpenAI) play out. Be that as it may, the commerce remains uncovered to dangers around tall obligation levels, unprofitability, legitimate vulnerabilities, and a overwhelming reliance on a modest bunch of major clients. Whereas these most recent bargains fortify the bull case for income and scale, they likely do not dispense with concerns around instability, insider offering, or the company’s shorter cash runway. On the other hand, overwhelming dependence on major clients and later insider offering show dangers you ought to be mindful of. In spite of withdrawing, CoreWeave’s offers might still be exchanging over their reasonable esteem and there might be a few more drawback. Find how much.

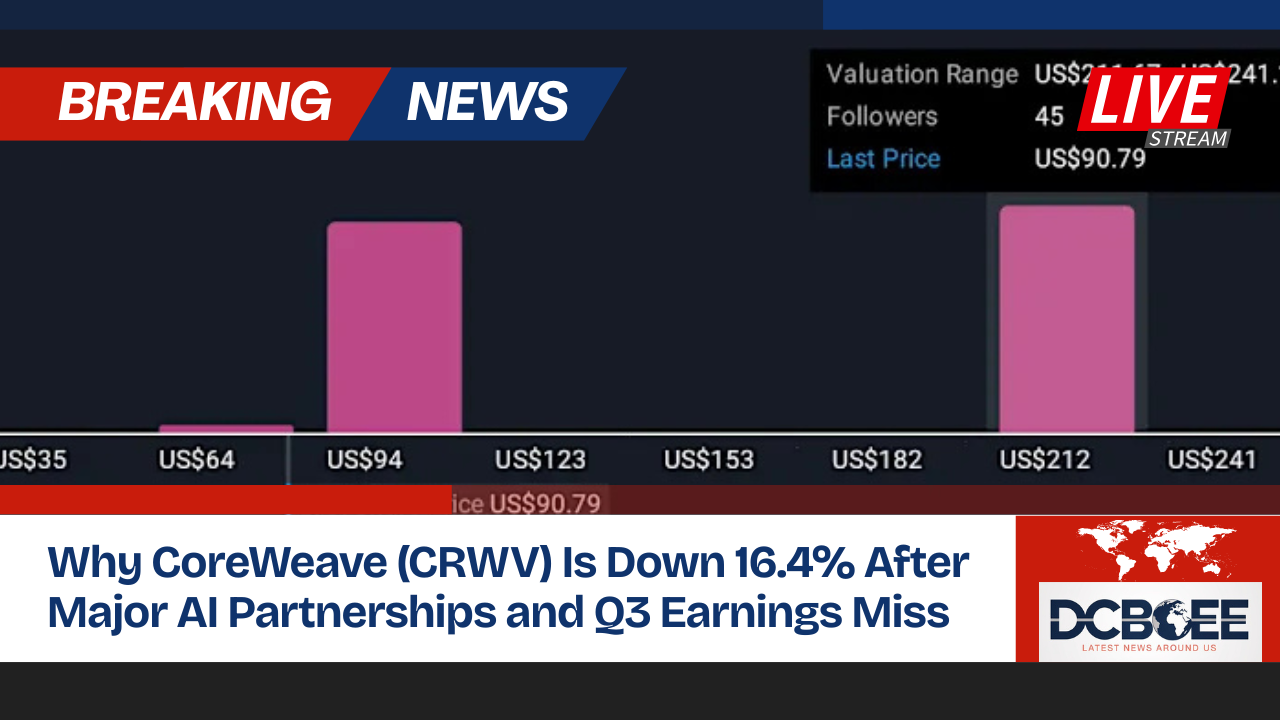

Exploring Other Points of view The Basically Divider St Community shared 87 reasonable esteem gauges for CoreWeave, with suppositions crossing from as moo as US$6.10 up to US$424.10 per share. Such a spread, numerous recommending extraordinary undervaluation, highlights fair how in an unexpected way person speculators see CoreWeave’s development story. Keep in intellect that whereas excitement around expansive AI organizations develops, concentration hazard and new legitimate issues may weigh on future assumption. Construct Your Possess CoreWeave Narrative

Disagree with this appraisal? Make your claim story in beneath 3 minutes – exceptional speculation returns seldom come from taking after the herd.

A incredible beginning point for your CoreWeave inquire about is our investigation highlighting 3 key rewards and 3 vital caution signs that may affect your venture decision.

Our free CoreWeave inquire about report gives a comprehensive principal investigation summarized in a single visual – the Snowflake – making it simple to assess CoreWeave’s by and large monetary wellbeing at a glance.

Looking For Elective Opportunities?

Opportunities like this do not final. These are today’s most promising picks. Check them out now:

This innovation seem supplant computers: find 28 stocks that are working to make quantum computing a reality.

Outshine the mammoths: these 25 early-stage AI stocks may support your retirement.

Trump’s oil boom is here – pipelines are prepared to benefit. Find the 22 US stocks riding the wave.

Source: https://finance.yahoo.com/news/why-coreweave-crwv-down-16-060638409.html

See Also: Trump demands $10,000 bonuses for air traffic controllers who worked during shutdown and pay